Learning How to Build a Capital Budget

Imagine you’re leading a department in a business.

But you know that your tech stack is outmoded. You need to upgrade. How do you know what investment will give you the highest ROI?

This is the sort of problem that needs a capital budget. Capital budgets help you assess the value of discounted future cash flows. If you work in finance, this is a standard tool in your tool belt. But for managers without financial training, what do you do?

When I was between my first and second year at the Darden (UVA) Business School, I tackled this problem, writing a book and accompanying software.

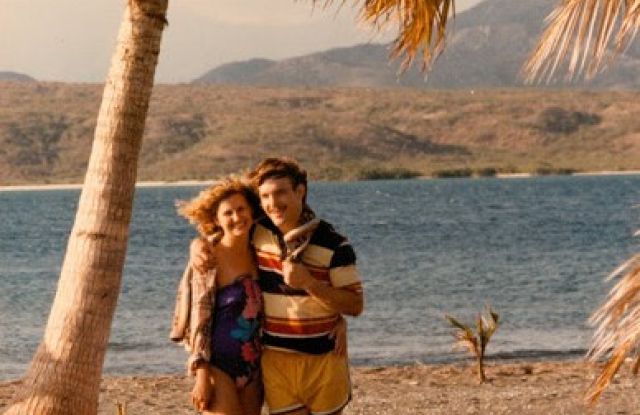

It was 1986.

The internet didn’t exist yet, so the software was written on floppy disks.

Ivy Software was the publisher. They hired me and a friend, Nancy Howard for the summer. After writing the book, I wrote the curriculum that would walk customers through a process of learning how to build their own spreadsheets. Nancy then programmed the software. I think the package retailed for about $600.

While it was a good summer and project for me, capital budgeting work is not something I enjoy. If I need a capital budget, I usually will ask someone else to do it.

Can you get a copy of Capital Budgeting? No. Ivy Software went out of business and I probably have the only copy of it in existence. I suppose most creative work is that way – it all burns up in the big fire.

Leave a Reply